I always hear things like:

"The rich get richer, the poor get poorer"

"The shrinking middle class"

"Tax cuts for the rich"

"Unfair burden on the poor"

"Greedy rich people"

It goes on and on. Most recently I hear congress and the President justifying their new programs by saying only people making over $250,000 a year will see tax increases. It seems fair on the surface. If you make a ton of money, you can afford to pay a few more taxes. But how much income taxes do the rich pay? And how much is enough?

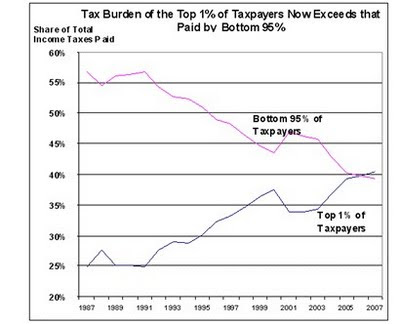

Looking at some of that data graphically:

This is rather unbelievable really. The top 1% tax payers in this country (1.4 million people) are now paying MORE than the bottom 95% of tax payers (134 million people) combined!

If you're doing the math you're saying to yourself... "that's only about 140 million people. I thought there were twice that many people in this country". You are right. The bottom 50% of wage earners in this country don't really pay any income tax at all.

Granted, the average income of the bottom 50% is only $15,000/yr. But if we get to the point where a majority of the country doesn't have to pay any income taxes (which is where we are headed), then you have created a permanent majority voting block that can vote itself whatever it wants. Free healthcare - Yes, Free housing - Yes, Free education - Yes, Free college - Yes, Free food - Yes, Free transportation - Yes, Free retirement - Yes, etc. And there will always be plenty of politicians ready to "help" the underprivileged.

“When the people find that they can vote themselves money, that will herald the end of the republic.” - Benjamin FranklinCharts via Tax Foundation

__________________________________________________

Please comment: Click "Comment", write comment, on comment as dropdown click "name/url", enter name on top line, hit "continue", hit "post"

No comments:

Post a Comment